reverse tax calculator australia

Gold State Super is a defined benefit scheme. Reverse Mortgages in Australia are governed by the National Consumer Protection Act 2009.

How Homeowners Can Optimize Their Tax Return Home Renovations Taxes Filing Taxes Tax Refund Refinance Loans

Save for an emergency fund Be prepared for lifes surprises.

. The order of the screens top to bottom will be their order within this Calculator Experience. Goods and services Tax. Sorry this is a retirement planning calculator and you have indicated that you are already retired.

Managing on a low income Get the most out of your money. 426006 of Industry Fund Services Ltd ABN 54 007 016 195 AFSL 232514. Goods and services Tax.

Your entire benefit from a taxed super fund which most funds are is tax-free. Attend our GST webinar to help you to understand GST and its implications for business. You can even determine the impact of any principal prepayments.

Tax-free you dont pay. Part is tax-free made up of. This calculator is for working people planning a transition to retirement.

Calculator Rates Fixed-rate 50-year Home Loan Calculator. Goods and services Tax 2019. Your income payment has two parts.

How to do a budget Plan and manage your money. Gold State Super was closed to new members on 29 December 1995. Australian Goods and Services tax history.

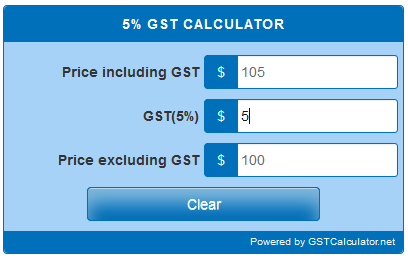

Wealth Creation Self-Managed Super Fund and Retirement Strategy services are not authorised by Infinity Group Finance Pty Ltd ACN No. Goods and services tax GST is a broad-based tax of 10 on most goods services and other items sold or consumed in Australia. You can edit the yellow button in the top left corner to change the.

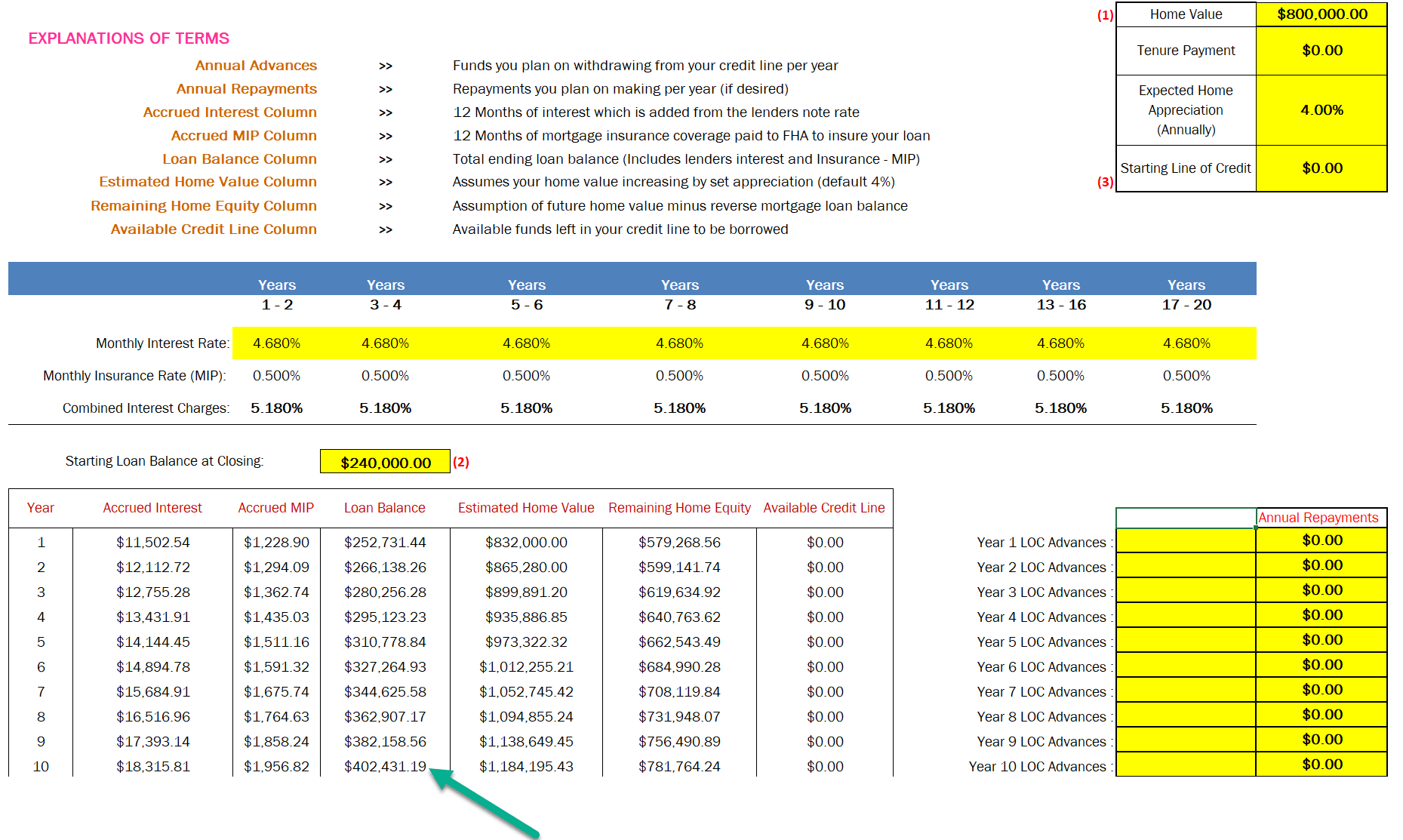

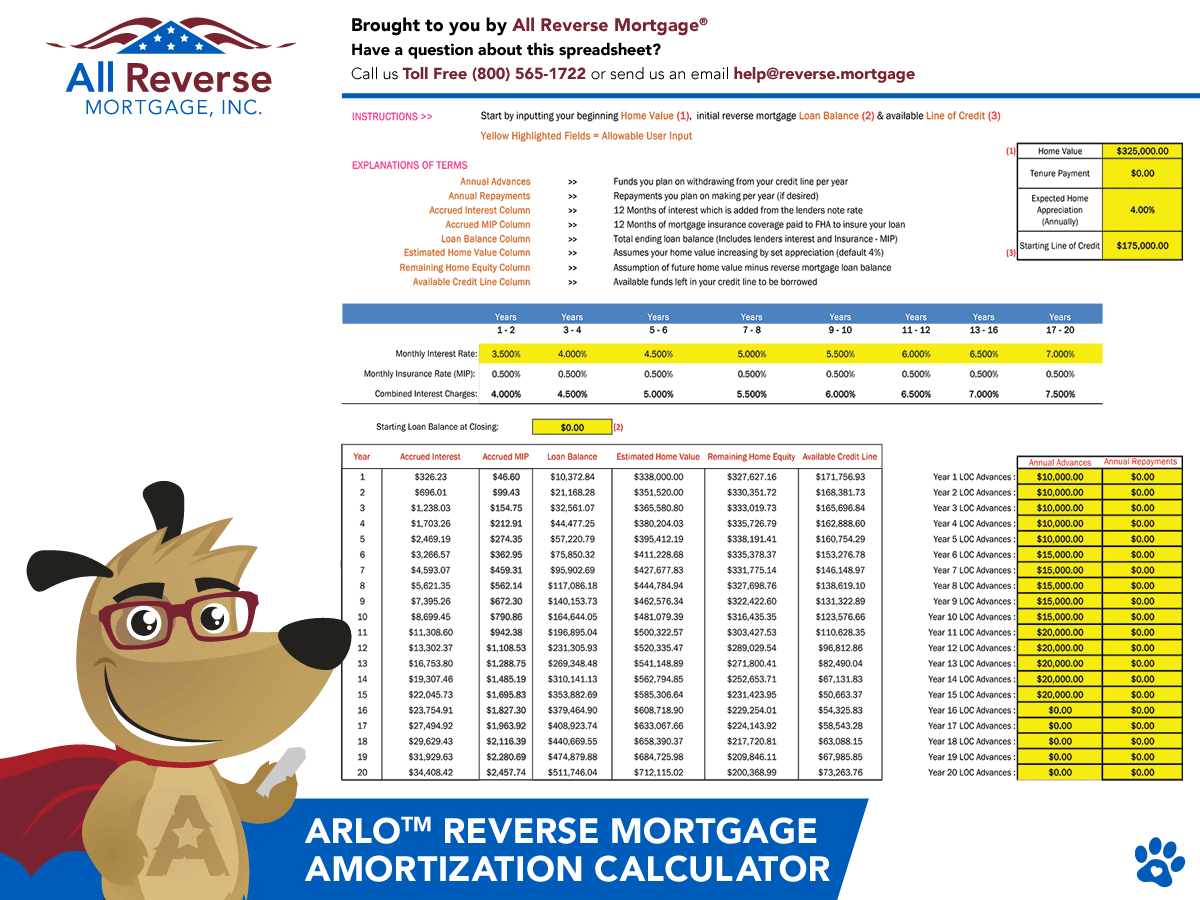

Some things dont have GST included these are called GST-free sales. There is a special rate of 025 on rough precious and semi-precious stones and 3 on gold. Mortgage Repayment Calculator Australia Use this calculator to generate an amortization schedule for your current mortgage.

This means your Final Benefit is determined by applying a fixed or defined formula. Reverse GST and PST tax calculator of 2022 for British Columbia BC in Canada. 609 889 607 and its Australian Credit Licence 505926 and the services provided by Infinity Group Australia Pty Ltd or associated entities or referral partners are subject to their own individual licenses for.

It can be used as well as reverse Goods and Services calculator. What is GST rate in India. Goods and services Tax 2020.

Adding fuel to the fire the government under Prime Minister Nakasone reduced corporate tax rates from 42 to 30 and slashed top marginal income tax rates from 70 to 40. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces. If youre age 55 to 59.

What is GST rate in Australia. Goods and services Tax. Please allow at least 1 year between current age and.

Financial counselling Free help to sort out your money. In Australia and across much of Europe. Français Home page calculator and conversion.

Home Price Downpayment. Goods and services Tax. Feel free to drop as many Calculator Screen instances as you require into the white area below.

Goods and services Tax 2020. You cannot end up owing us more than the house is worth. If youre age 60 or over.

It looks like you are retiring now you will need to have at least 1 year of transition to use this calculator. This is a Global Template that holds another type of Global Template called Calculator Screen. Current GST rate in India is 18 for goods and services.

Press the report button for a full amortization schedule either by year or by month. Urgent help with money If youre struggling or in crisis. Problems paying your bills Understand your options.

Calculate Sales tax US. Taxable taxed at your marginal tax rate less a 15 tax offset. The no negative equity guarantee NNEG clause introduced in 2012 means you are protected by law and cannot owe more than your home is worth irrespective of the value of the property.

Gold State Super is not market-linked so your funds are not impacted by the performance of investment markets. GST in Australia was started to charge on 1st of July 2000. Quickly see how much interest you will pay and your principal balances.

Keens own contribution at the time was. Special GST rates in India. There are reduced rates 0 5 and 12 for some goods and services and 28 luxury rate for some items.

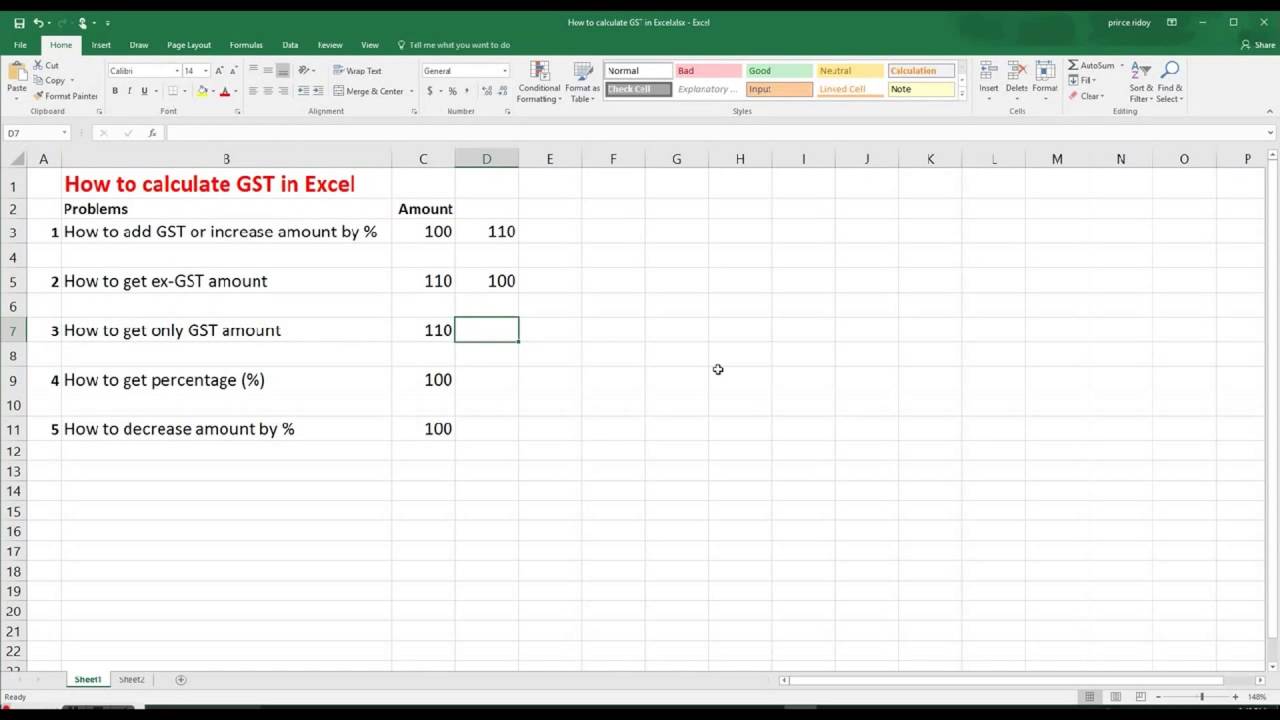

It is easy to calculate GST inclusive and exclusive prices.

Age Pension Calculator Noel Whittaker Interest Calculator Wealth Creation Investing

Reverse Tax Calculator Net To Gross

Commercial Property Lease Or Buy Analysis Calculator Investment Analysis Commercial Property Analysis

![]()

Free Income Tax Calculators Australia Ashburn Tax Accountants

Which Is Best Fixed Vs Adjustable Rate Reverse Mortgages

5 Percent Gst Calculator Gstcalculator Net

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

Free Reverse Mortgage Amortization Calculator Excel File

Loan Calculator Pro Apps On Google Play

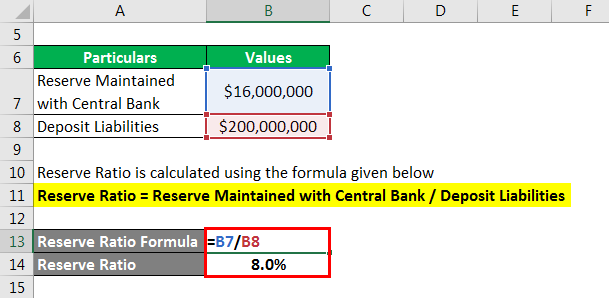

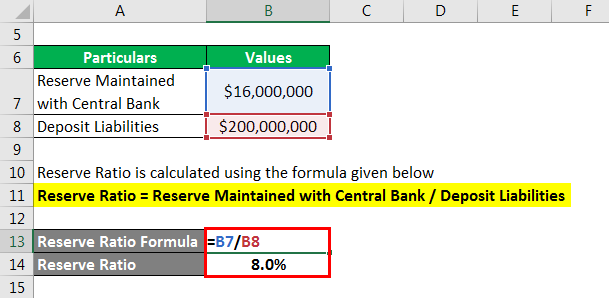

Reserve Ratio Formula Calculator Example With Excel Template

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

How To Calculate The Tax In Australia Quora

How To Calculate The Tax In Australia Quora

Reverse Percentages Calculator Online

Reserve Ratio Formula Calculator Example With Excel Template

Your Vat Reverse Charge Questions Answered Freshbooks Blog

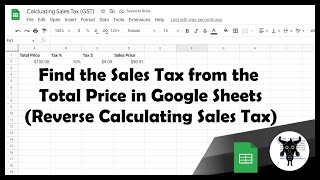

How To Easily Calculate Sales Tax Gst In Google Sheets Yagisanatode