portability estate tax exemption

Lavelle Finn. His estate will have both his own exemption of 1206 million plus Rosies unused 706 million exemption for a total of exemption of 1912 million.

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group

Theres another important exemption from generation skipping transfer tax or GST.

. However by applying for portability of the first to dies unused exemption when heshe passes away the surviving. Ad Settling a loved ones estate can be time consuming. The government allows an estate tax exemption a.

The portability of the federal estate tax exemption for married couples eliminated the need to plan in such a way. Lastly one important limitation on portability is that it only applies to the estate and gift tax exemption. Portability helps minimize federal gift and estate taxes by allowing a surviving spouse to use a deceased spouses unused gift and estate tax exemption amount.

A limited amount of a persons wealth can be transferred to his or her loved-ones free from gift estate and generation skipping transfer tax. Heres one of the tricks to. What You Need to Know About Estate Tax Exemption.

Estate tax portability applies to married couples only. 2017-34 the IRS provided a simplified method for obtaining an extension of time under Regs. Clarifying the executor process one step one day and one tool at a time.

This doesnt mean your estate automatically pays taxes after you die. 3019100-3 to make a portability election under Sec. If one spouse dies before another and doesnt use 100 of hisher estate tax exemption the surviving spouse can use.

Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013. Were here to make it easier. Will Contests Breach of Fiduciary Duty Fraud Beneficiary Rights Right of Election etc.

On July 8 2022 the Internal Revenue Service issued new guidance that allows a deceased persons estate to elect portability of their unused gift. The portability feature means that when one spouse dies and his or. Call for a free case evaluation.

Sylvia passes away in 2022 when the estate tax exemption is 1206 million. Commercial Real Estate. 2010 c 5 A if that.

More families can now take advantage of a 2412 million portable estate tax exemption. Currently the amount exempt from. The option of portability can make a significant difference when it comes to taxation of an estate.

After all electing portability could mean that a surviving spouse could have double the estate tax exemption at the second death currently 5430000 x 2 10860000. The American Taxpayer Relief Act of 2012 ATRA which was signed into law by President Obama on January 2 2013 made two. The United States Internal Revenue Service is a.

Ad Experienced Estate Trust and Probate litigation Attorney. Internal Revenue Service Portability Estate-Tax Exemption Follow. We waited a long time many would say too long for estate tax legislation and when it arrived in December 2010 it.

Back to All Articles. Typically portability estate tax allows an executor to act on behalf of the deceased spouse to exercise the options available for estate tax exemption amount that remained unused at the. For families with significant wealth a new IRS.

Portability of the Estate Tax Exemption. Portability of Estate Tax Exemptions. Assume that at the time of Jennifers later death the federal estate tax exemption is still 5340000 the estate tax rate is 40 percent and Jennifers estate is still worth 8000000.

The tax for the estate would be 568000 at a 40 tax rate. Two important aspects to remember are that the portability exemption is only available to. Sylvias taxable estate is 294 million 15 million less 1206 million resulting in an estate tax of.

Estate Tax Portability In A Nutshell Postic Bates P C

Exploring The Estate Tax Part 2 Journal Of Accountancy

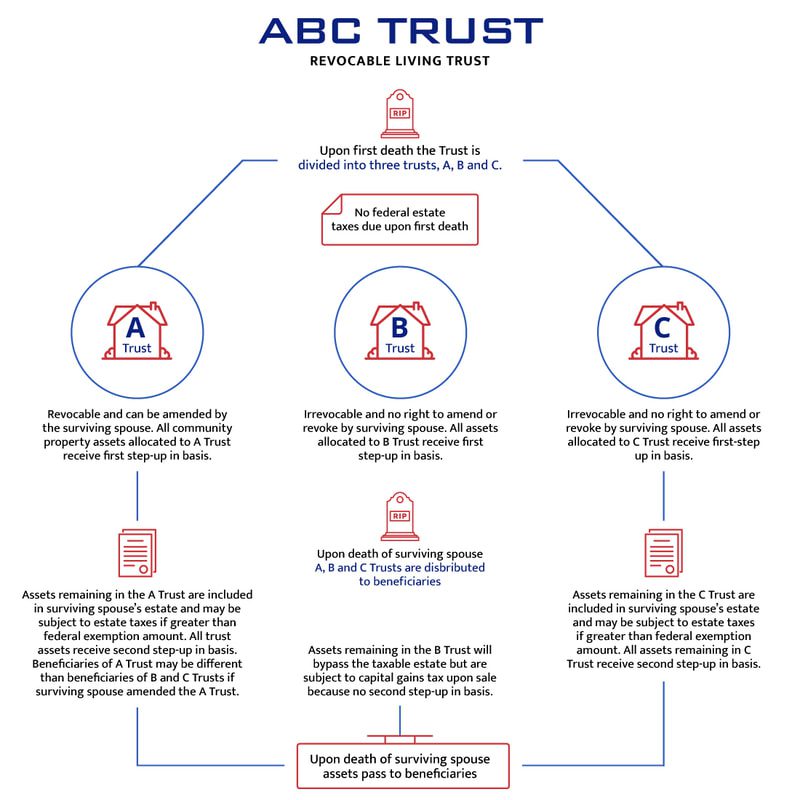

To A B Or Not To A B That Is The Question Botti Morison

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Temporary Increase In Estate Tax Exemption And Portability Gudorf Law

Estate Tax Cincinnati Estate Planning Attorney Will Trust And Probate

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Preserve Both Estate Tax Exemptions With Portability Skeen Law

Properly Preparing The Form 706 Estate Tax Return A 2 Part Series Ultimate Estate Planner

Estate Planning Can Secure Your Legacy Jackson Fox Pc Ardmore Ok

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

West Palm Beach Tax Elder Law Possible Estate Tax Law Changes And The Portability Election

The New Estate Tax Exemption And Portability Panacea Or Poison

Relief From Irs Portability Of Lifetime Tax Exemption Extended Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

Portability Of The Estate Tax Exemption Cdh Law Pllc

The Practical And Potentially Perilous Pitfalls Of Portability Financial Planning Association